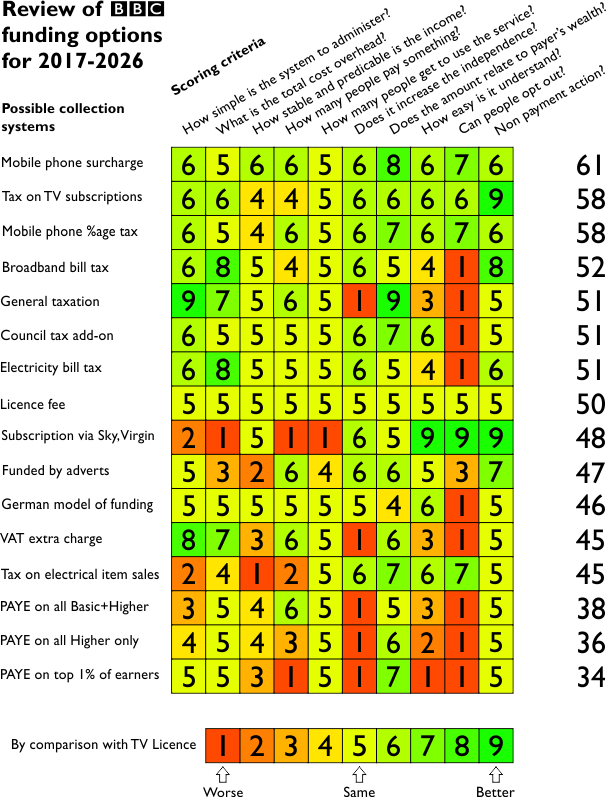

BBC 2017: Tell me about the 16 options to collect the BBC 4 billion quid a year?

Does Paying six British pounds a month to fund Broadcasting have your Corporation? Photograph: Shutterstock

After the feedback from posting the original table (on the BBC 2017: Which of these 14 options is best to collect 4 billion quid a year? page), I have added in two extra lines to the graphic to show the "German Model" (thanks to KMJ,Derby) and "ad funded" (thanks to trevorjharris).

Reference material

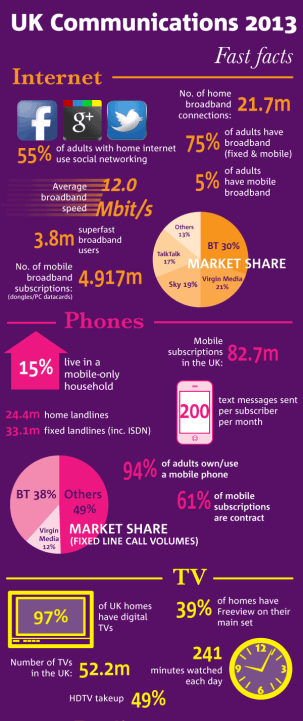

Much of the inspiration for thinking up these funding methods came from this Ofcom - Facts & Figures page. I have reproduced the graphic down the right hand side for your reference.

Much of the inspiration for thinking up these funding methods came from this Ofcom - Facts & Figures page. I have reproduced the graphic down the right hand side for your reference.

Funding method: Mobile phone contracts surcharge

- How it works: Extra tax on each mobile contract phone line

- Who pays: Anyone with a mobile phone/broadband contract pays £6 per month extra.

- Who watches the BBC services: Everyone

- Payments collected by: Mobile phone operators

- Pros: Simple to collect from small group of corporations, low individual charge

- Cons: : Not technically progressive

I thought it was odd this came out on top, but there are obvious advantages. People with PAYG phones would be excluded, so low/no income people would be self-excluded (or those who object to the BBC on principle). As homes with two mobile phones would be revenue neutral, and businesses that supply mobiles to workers would be making a contribution.

The number of contracts would be stable and so the actual monthly value could be adjusted easily. Low income charities might feel the pinch if they have low-cost high-users mobile phone contracts as part of their public services.

It does not seem unreasonable that a household with three or more mobile phone contracts could probably afford £6 a month extra.

Funding method: Tax on TV subscriptions

- How it works: Extra payment from pay TV viewers

- Who pays: Households with Pay TV

- Who uses: Everyone

- Collected by: Sky, Virgin, BT, TalkTalk etc

- Pros: Easy to collect from a few large corporations.

- Cons: : Progressive tax, but falls "unfairly"

This is a simple method of collecting money from homes that have self-selected to pay more for their television service. It would be a charge on 10.5m Sky TV subscribers and 3.8m Virgin TV subscribers. This would mean raising £21.30 a month from each of these homes: they would be £9 worse off, but non-subscribing homes would be £12 a month better off. This would be Progressive, but not in a fair way.

Funding method: Mobile phone contract tax

- How it works: Extra tax on total mobile phone contract bill

- Who pays: Anyone with a mobile phone contract has percentage (say 5%) charge on total bill

- Who uses: Everyone

- Collected by: Mobile phone operators

- Pros: Simple to collect from small group of corporations

- Cons: : Poor stability of income

This is an attempt to make the "Mobile phone contracts surcharge" fairer by adding on (as it does with VAT) an additional charge to the total value of each monthly mobile phone contract bill.

This would make it more progressive: low users would pay less. However the income would be less predicable and this would also be - as most contracts have a device-funding component - a tax on hardware purchase.

Funding method: Broadband bill tax

- How it works: Tax on having a broadband

- Who pays: 21.7m households pay £14 per month (or £11.50 per month if 5m mobile broadband also pay)

- Who uses: Everyone

- Collected by: BT, Virgin Media, Sky, TalkTalk and others

- Pros: Easy to collect from small number of private companies

- Cons: : Basically the TV Licence by another name. Could slow down broadband take-up.

This will be revenue neutral for most homes. For most people it would just have the added convenience of making the payment on an existing communications bill. There is certain logic to having the BBC services linked to broadband, especially going forward.

Funding method: General taxation

- How it works: Annual payment made from total government tax take

- Who pays: Everyone (more or less) and businesses

- Who uses: Everyone

- Collected by: HMRC

- Pros: Easy to arrange. Divert 0.61% of existing government revenues to BBC

- Cons: : Political interference unavoidable.

If there could be a way to fix the BBC's income in a way that did not allow a Chancellor to put pressure on BBC News, then this would be an obvious way to fund the BBC. It is the nature of the beast that makes such a proposal only possible in Cloud Cuckoo Land.

Funding method: Council tax add-on

- How it works: Additional council tax item

- Who pays: All households. Set so Band D pay £12.50 a month extra

- Who uses: Everyone

- Collected by: Local councils

- Pros: Straightforward to collect. Some level of progressiveness to the tax

- Cons: : The collection is backed by criminal sanction.

This is another form of the TV Licence by another name. The simplicity of all households paying (if they have a TV or not) and the use of the existing collection system of the local councils are key benefits. For most homes this would be revenue-neutral. Band A could pay 50% and the top band 200%, with the in-between bands pro-rata. There could be also a single-occupancy discount.

The usual issues with the council tax (no-income person living in a large house) would arise, but there would be a linkage between wealth and contribution.

If you can pay for the streets to be cleaned this way, why not the BBC?

Funding method: Electricity bill tax

- How it works: Tax on electricity consumption

- Who pays: All households, businesses etc

- Who uses: Everyone

- Collected by: Power companies

- Pros: Simple to collect. Pre-payment meter options for poor households.

- Cons: : Basically the TV Licence by another name. Loss of power for non-payment.

This method is used in other countries (such as Greece) and could provide a stable, predicable income. It is a per-household charge (but would also require payment from non-domestic use). Would be revenue neutral for most people, but no chasing for payment from the TV Licensing people .

Funding method: Licence fee

- How it works: Each TV owning household makes annual payment

- Who pays: Households operating a TV set (almost all 26.22m)

- Who uses: Everyone

- Collected by: TVLC

- Pros: Existing system

- Cons: : Not progressive. Relies on criminal sanctions backstop

The main objections, such as perceived unfairness for non-TV owners (who are sent terrifying ... letters), and the non-Progressive nature of the tax (every home pays the same, from single poor occupant to rich large family), are usually a Trojan Horse argument. The 3% who do not pay are disproportionally vocal online, as they do not have a TV to entertain them.

Funding method: Subscription via Sky, Virgin etc

- How it works: Subscription system gatekeepers

- Who pays: TV Households choosing service

- Who uses: Subscribing households, radio free

- Collected by: Sky, Virgin

- Pros: Uses existing TV subscription systems. Could be compulsory.

- Cons: : Considerable overhead costs in denying non-payers access

I have game-played this option here: BBC, plc 2017: BBC announcement.

Funding method: Adverts

- How it works: Less programmes, 16 minutes and hour of adverts

- Who pays: People who buy products and services

- Who uses: Everyone

- Collected by: From advertisers

- Pros: No TV Licence

- Cons: : Probably put ITV and Channel 4 off air.

I have game-played this option here: BBC plc 2017. June: Media Talk discusses the ad-funded Auntie

Funding method: German Model

- How it works: As per TV licence, but all household pay

- Who pays: All households

- Who uses: Everyone

- Collected by: Either TVLC or added to Council tax

- Pros: Easy and cheap to collect

- Cons: : No opt-out, flat rate so non-Progressive

The German funding model, where a flat charge is made to every household whether there is TV usage or not, is one option This would stop expensive process of determining if non-payers are evaders or those "freaks" who do not actually have TV set.

This could be done either by giving TVLC the right to charge every home, or by adding a flat charge of £12.50 a month to Council Tax bills of all shapes and sizes.

Funding method: VAT add-on

- How it works: Change to VAT rate by +0.9% to specifically fund BBC

- Who pays: Everyone

- Who uses: Everyone

- Collected by: HMRC

- Pros: Very easy to collect.

- Cons: : Political interference unavoidable.

Put VAT up to 20.9% to fund the BBC and not expect constant political meddling? Are you mad?

Funding method: Tax on electrical/TV purchase

- How it works: Extra tax at point of sale

- Who pays: People buying new TVs

- Who uses: Everyone

- Collected by: Retailers

- Pros: None

- Cons: : Tax rate would be very high to provide level of funding. Online retail makes charge easier to avoid.

The charge would be so high as to double the price of a television. This is basically a non-starter. Even if the charge was to all electrical items and white goods, this would be hated by retailers and loved by people visiting the rest of the EU to buy stuff there.

Funding method: PAYE add-on Basic and Higher

- How it works: Change to PAYE rate specifically to fund BBC

- Who pays:Everyone who earns income. Small change to basic rate of tax paid by all earners over £10k.

- Who uses: Everyone

- Collected by: HMRC

- Pros: Very easy to collect.

- Cons: : Basic rate of tax politically hard to increase. Political interference unavoidable.

Putting up the basic rate of income tax is politically not an option.

Funding method: PAYE add-on

- How it works: Change to "40%" band to fund BBC

- Who pays: 5 million people who earn over £32k. Would mean upping the 40% to 42% or £60 pm flat charge

- Who uses: Everyone

- Collected by: HMRC

- Pros: Very easy to collect.

- Cons: : Political interference unavoidable partially breaks link between payment and service.

Getting the "middle earners" to pay for the BBC would render the link between the public and the BBC broken. When not pandering to the politicians, the BBC might become really, really middle class. Or at least have no defence to such an accusation.

Funding method: PAYE add-on, top 1% of earners

- How it works: Changes to make top 1% pay

- Who pays: top 1% of earners ... pay £12.5k each

- Who uses: Everyone

- Collected by: HMRC

- Pros: Very easy to collect.

- Cons: : Totally breaks link between payment and service.

The idea of the "1%" paying for the BBC sounds attractive from an envious point of view, but would shift the corporation from service the public to serving the elite.

I hope this fleshes these proposals out in your mind a little more than the raw numbers did. As ever I will be interested to know if you feel that one of these proposals has your support or interest.

Friday, 28 March 2014

M

Mike Dimmick11:45 AM

Council tax is *not* backed by criminal sanction. This is actually a major flaw - councils largely cannot recover all the money owed by non-payers - and should, in my opinion, be corrected.

See Council Tax arrears - GOV.UK for the legal position. Yes, you can still be sent to prison for persistent non-payment but it still doesn't actually give you a criminal record.

It would be instructive to see what the evasion rate is for council tax, and how that compares to the TV licence. That would indicate how much the change to being a civil offence would cost.

| link to this comment |

T

trevorjharris12:02 PM

Just to show how bad these funding methods are just take the example of mobile phone contracts surcharge.

On a selfish note all my mobile phones are PAYG so I would not pay anything.

It would be easy for companies like Vodaphone to move UK contracts to another country to avoid the surcharge. By the way not everyone watches BBC services.

Another example is the Electricity bill tax. The Government it desperate to reduce energy prices and applying an extra tax is totally politically unacceptable.

| link to this comment |

Mike Dimmick: the council tax link is interesting... But it doesn't say you won't get a criminal record if you are sent to prison. I'm not sure how you can be sent to prison without it being a crime.

| link to this comment |

Sunday, 30 March 2014

Interesting to see how the rest of the world deals with their license fee management strategies, could the BBC not adopt a proven workable option from this ?

Link Television licence - Wikipedia, the free encyclopedia

| link to this comment |

Alvin Pritchard: Perhaps the model used in Austria, Denmark, France, Ireland,Italy, Poland, Sweden, Switzerland. Norway..?

| link to this comment |

D

david4:44 PM

Salisbury

turn the bbc into public service broadcaster scrap bbc 1 merge bbbc 2/4 close news 24 close bbc radio 1/2 local broadcasting sell bbc commercial arm result poll tax fee 25 pounds

| link to this comment |

david's: mapD's Freeview map terrainD's terrain plot wavesD's frequency data D's Freeview Detailed Coverage

L

LindaB7:58 PM

david:

BBC *is* PSB (Public Service Broadcasting) already, or is supposed to be. Many people like BBC1 programming and more like BBC2 and BBC4. Others like the News 24 service and so on.

The BBC commercial operation gains revenue that is used for more programming (or so they say).

The big problems with BBC seem to be a perceived leftist bias, news and current affairs reporting that is either partisan or carefully controlled, as well as science and technology reporting that is seen by some is only supporting the 'consensus' view and not allowing proper debate.

So I don't see where your £25 comes from.

| link to this comment |

M

MikeB11:15 PM

LindaB: The real problem is that the 'BBC seem to be a perceived leftist bias, news and current affairs reporting that is either partisan or carefully controlled' is a perception, and no more than that. The reality is rather the opposite, as a lot of research shows.

As for 'consensus' over science, if you mean on climate change, then the BBC actually qualifies the hell out of any climate change science, when it is clear that every scientific academy on the planet, the CIA, the Pentagon and 97% or more of climate scientists agree with AGW being real and man made.

As for those finding an alternative to the licence fee, try to find one which does not involve government directly controlling the BBC budget, which does not involve politically impossible ideas such as tacking it on to Council Tax, etc, and does not involve killing the ad revenue of the commercial TV sector. And as for the idea of adding £10 to the sale price of TV's/ laptops - £10 is the gross margin for a laptop in a store, and not much more than that on a TV - the BRC would kill such an idea instantly.

'When the impossible has been eliminated, what remains, however unlikley, must be true' - thats the licence fee.

| link to this comment |

Monday, 31 March 2014

T

trevorjharris11:30 AM

@MikeB

Consensus should never used as if it is a scientific argument. For over 400 years there was a consensus that Newtons Law of Gravity was correct. It was Einstien that proved them wrong. In the 1930's there was a consensus among doctors that smoking was good for you!

If people want the BBC to be advert free the simple answer is a subscription service. It is likely that the BBC would get considerably less money than it gets now and would have to cut back. In my view that would be a good thing.

My own view is the BBC should use a combination of subscription and adverts. They could have a free to air channel payed for by adverts and some premium channels paid for by both subscription and adverts. Like Sky they could have no adverts during Films or Sports events.

| link to this comment |

M

MikeB1:43 PM

trevorjharris: How could I guess your views on climate change.....

I suggest you look at the Royal Societies/NAS report on climate change

Climate change | Royal Society

or www.skepticalscience.com . And its worth pointing out that a statistical link between smoking and cancer was shown by Isaac Adler in 1912, and by 1929, German researchers had published studies strongly linking cancer to smoking, with their government strongly backing anti-smoking measures right through the 30's. Dont confuse what the media says with what peer-reviewed science says.

And if there is a consensus amoungst cardiologists that you need heart surgery, do you ignore them in favour of the person on the net that has no medical qualifications, but says you'll be just fine?

Your still suggesting solutions which are impractical at present, and have been shot down many times before. There is no way to introduce a Beebox without a great deal of expense, and equipment which could take a subscription card are few in number. If you want such a move, its going to take years for them to be universal. And again, how is having yet another player in the TV advertising market going to help existing companies - the same pie, cut more ways is not going to give the BBC the income it needs, or allow decent programming from anyone else.

| link to this comment |

Select more comments

Your comment please!