Income-based broadcast support tax

You get an email. It's from the Broadcasting Support Agency. It says that you must make immediate arrangements to pay them £103.

You click the link on the website and it says that you need to make arrangements to pay this sum, but first it asks you some questions?

Are you over 75?

Because if you are, you don't need to pay. You just need to provide your national insurance number to prove that you are this old.

Was your taxable income last year less than £5600?

If it was, and you can prove this by giving your national insurance number, then you don't have to pay this year. The BSA will contact you again next year.

Was your taxable income last year less than £15,150?

If it was, you are only required to pay 0.68% of that amount to the BSA. Just provide your national insurance number.

If you earned £6000, you pay £41, earn £8000 pay £54, at £10000 it is £68 and at £12000 about £82.

Did you have a TV Licence for your current address?

In the first year of operation, you get a discount for the part of the year for which you can provide a TV Licence number for the address your provide to the BSA.

There are certainly benefits to this system if you want to have a progressive tax. However, somewhere between two and three times as many people will need to be contacted.

Another advantage from the collection point-of-view. If a person misses payment in the first year it will still be due and can be collected when they first provide their payment and/or national insurance number.

The biggest beneficiaries would be stay-at-home parents, as a household with one high earner and one non-earner would pay much less than today.

The requirement of UK residency, rather than possession of a TV, means that there is no requirement for home inspections, keeping costs down (no "TV Detector vans").

The main technical issue would be providing the link between the BSA and the Inland Revenue to confirm low incomes or 75-year old pensioner status.

The main problems would be for people who have no income and currently don't need to prove this, and for those people who have low income with a discrepancy with the Inland Revenue.

The question of overall costs of moving from a per-household charge to a per-person charge is also a good one.

In a sensible world, there would be a proper hand-over from the TV Licence to the BSA: however mapping from households to people would be imperfect.

I note with interest that the 0.68% figure is very, very close to the 0.61% I came up with for "Funding method: General taxation" - BBC 2017: Tell me about the 16 options to collect the BBC 4 billion quid a year?

| link to this comment |

6:58 PM

Wont this mean even less income considering the amount of people on low income? People on a higher income will be moaning and quite rightly so for having to pay more for the same service.

| link to this comment |

Ian: So. You want a progressive tax, but everyone pays the same?In fact, only 1 million uk adults are on minimum wages, out of the total of 30 million.I estimate 3 million might get reduced rate here. Perhaps 2 million will qualify as being unemployed?

| link to this comment |

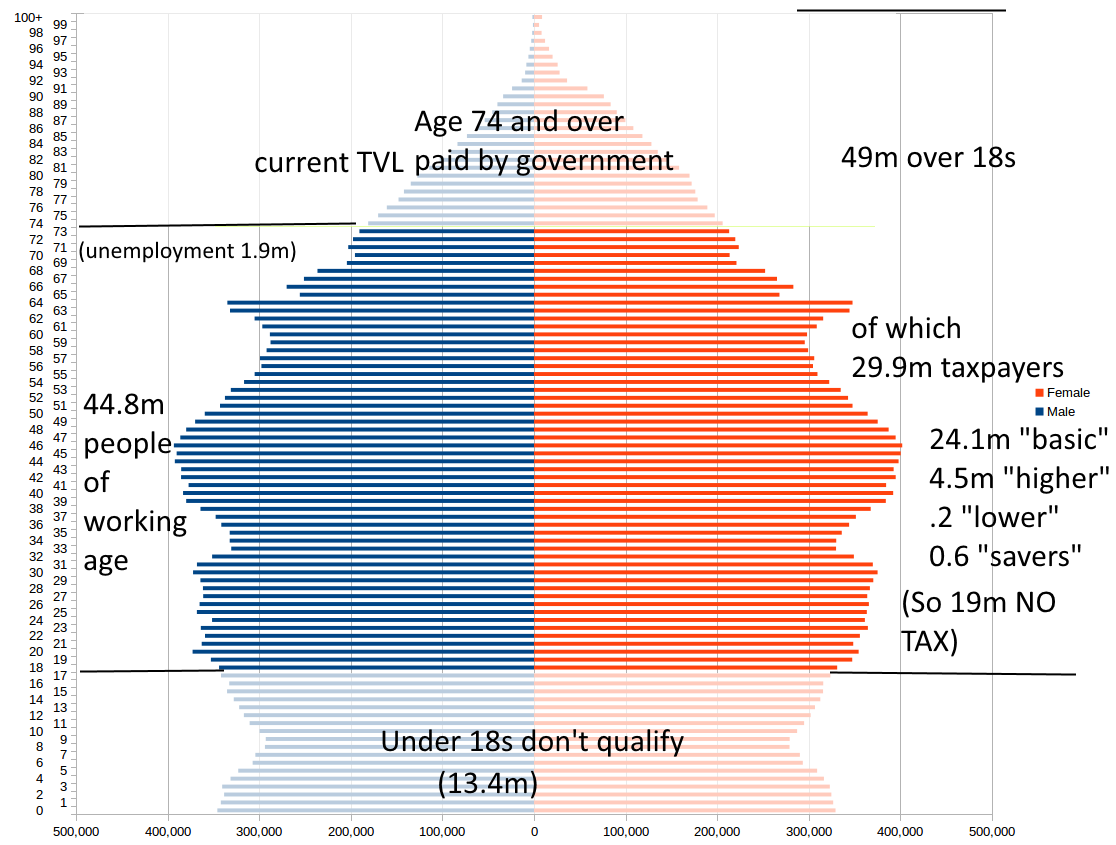

Here's the breakdown on the UK population using File:Population pyramid for England using 2011 census data.png - Wikipedia, the free encyclopedia and https://www.gov.uk/govern…age.

| link to this comment |

So, £103 x 30m taxpayers = £3,090m + £500m for over-75s. Only a little short of £4bn. Might have to raise the level to £117 to get the full (current) amount.

| link to this comment |

9:08 AM

Sounds too much like Maggie's hated poll tax -and look what happened to that !

Take a household with two working adults and 2 offspring living at home -earning enuf to exceed the £15150 each, but hardly a wealthy household -you expect them to pay in excess of £400 for a TV Licence ie the Beeb ???

Ain't going to happen!!

| link to this comment |